Why Your Business Needs a 2D Payment Gateway for Seamless Deals

Why Your Business Needs a 2D Payment Gateway for Seamless Deals

Blog Article

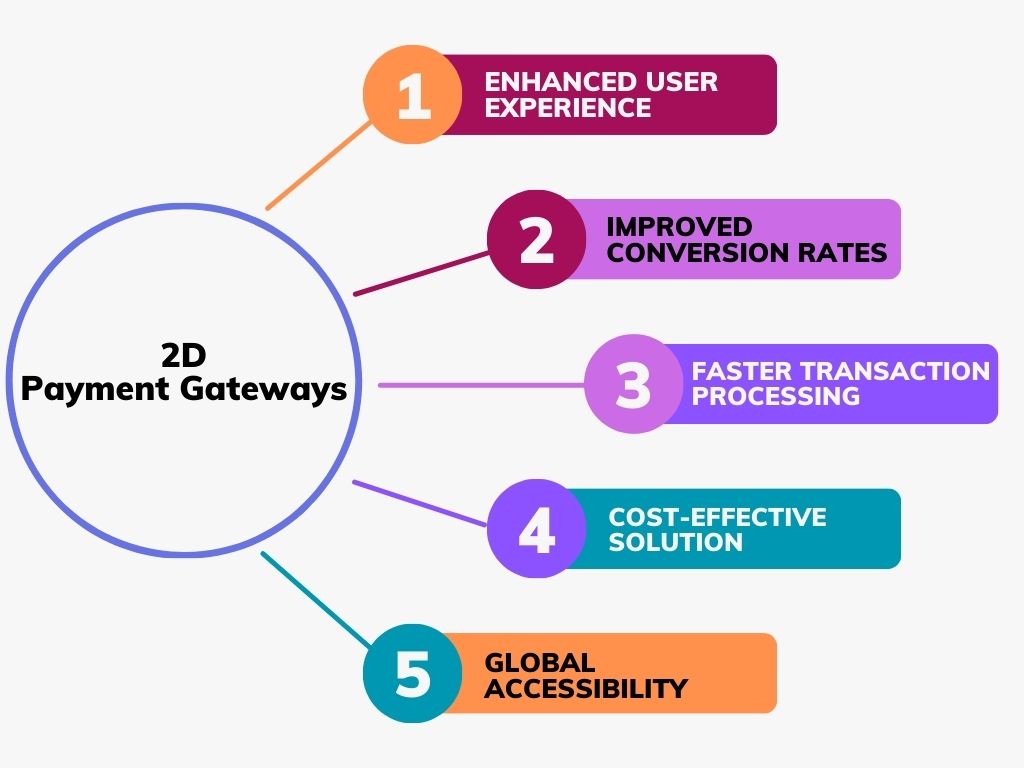

Exploring the Perks and Qualities of a Versatile Repayment Portal for Seamless Transactions

In today's digital economic situation, the option of a settlement gateway can dramatically influence the consumer experience and overall service success. A functional payment entrance not just provides boosted security functions to shield sensitive data however additionally offers several settlement options customized to varied consumer needs.

Enhanced Safety And Security Attributes

In the digital age, boosted security functions are extremely important for settlement gateways, guaranteeing the security of delicate economic information. As online transactions proliferate, the danger of information violations and fraudulence increases, making robust safety and security steps crucial for both businesses and consumers. Repayment portals employ numerous layers of security procedures, including encryption, tokenization, and safe and secure outlet layer (SSL) modern technology, to safeguard purchase information during processing.

Encryption converts sensitive information right into unreadable code, stopping unapproved access throughout transmission. Tokenization further enhances protection by replacing delicate data with one-of-a-kind recognition icons or tokens, which can be used for handling without revealing the original data. Additionally, SSL certifications develop protected connections in between the customer's web browser and the server, ensuring that information exchanged remains personal.

In addition, conformity with industry standards such as the Settlement Card Market Data Security Criterion (PCI DSS) is important for payment portals. Abiding by these standards not just aids safeguard against safety vulnerabilities yet likewise promotes trust amongst users. Inevitably, the application of advanced security functions within payment entrances is vital for keeping the integrity of economic transactions and making certain a risk-free online buying experience.

Multiple Repayment Alternatives

Using multiple repayment options is important for suiting diverse consumer preferences and boosting the overall purchasing experience. A flexible payment portal allows companies to incorporate various repayment techniques, including credit score and debit cards, electronic purses, financial institution transfers, and also cryptocurrencies. This versatility not just deals with a larger target market but likewise increases customer fulfillment and loyalty.

Along with fitting customer choices, a robust repayment gateway can simplify the deal procedure, enabling for quicker checkouts and lessening friction during the settlement stage. This performance is vital in today's fast-paced ecommerce setting, where consumers anticipate seamless purchases.

Eventually, offering a variety of repayment options not only improves customer experience but likewise placements businesses to stay affordable in a rapidly developing electronic landscape. Welcoming this flexibility is a calculated move that can yield considerable rois.

User-Friendly Interface

An effective customer interface incorporates clear navigating, visually enticing design, and quickly recognizable switches. These aspects overview customers seamlessly via the repayment process, decreasing the risk of desertion. Furthermore, the interface needs to give real-time responses, such as confirmation messages or error informs, which informs customers of their deal standing and guarantees them that their sensitive info is secure.

Furthermore, an user-friendly payment entrance accommodates various customer choices, such as language options and ease of access features. This inclusivity not only widens the customer base however likewise boosts total user contentment - 2D Payment Gateway. By focusing on an user-friendly interface, companies can promote trust fund and commitment, check this site out inevitably leading to enhanced income and long-lasting success

Combination Abilities

Efficient combination abilities are crucial for any kind of settlement gateway, as they determine how perfectly the system can get in touch with existing service applications and systems. A flexible repayment entrance must support numerous combination methods, consisting of SDKs, apis, and plugins, which allow organizations to integrate payment handling into their websites, mobile applications, and ecommerce platforms with marginal interruption.

Robust assimilation choices enable services to leverage their existing infrastructure while boosting capability. The capability to integrate with popular shopping systems such as Shopify, WooCommerce, and Magento is especially advantageous, as it simplifies the settlement process for customers and sellers alike. In addition, compatibility with client relationship monitoring (CRM) systems and business resource preparation (ERP) software program enhances operations, cultivating much better data management and coverage.

Additionally, a settlement portal that supports get more multiple programming languages and structures supplies organizations the adaptability to personalize the combination according to their distinct requirements. This adaptability not just improves individual experience but also enables quicker alterations and updates, making sure that services can reply to evolving market needs successfully. Eventually, strong assimilation capacities are crucial for services seeking to optimize their settlement procedures and improve total operational effectiveness.

Improved Transaction Rate

Seamless integration capacities prepared for achieving enhanced transaction rate within a payment portal. By making sure compatibility with numerous e-commerce systems and systems, services can facilitate reliable and quick settlement processing. This structured integration lessens the time required to finish transactions, eventually boosting the client experience.

Another significant facet of boosted purchase speed is the reduction of manual treatment. Automated procedures lower human error and quicken the confirmation and permission stages, enabling rapid authorizations - 2D Payment Gateway. Furthermore, making use of durable APIs allows seamless interaction in between different systems, better improving transaction performance

Verdict

In verdict, a versatile repayment portal considerably boosts transaction processes with its robust security functions, varied settlement options, and user-friendly user interface. more tips here The relevance of selecting an efficient repayment portal can not be overstated, as it plays an important duty in the success of online transactions.

A versatile repayment entrance not just supplies boosted security features to safeguard delicate information however additionally gives numerous payment choices customized to varied customer requirements.In addition, conformity with sector criteria such as the Settlement Card Sector Data Safety And Security Standard (PCI DSS) is crucial for repayment gateways. A flexible settlement gateway allows companies to integrate various payment methods, consisting of credit report and debit cards, electronic purses, bank transfers, and even cryptocurrencies. When customers experience a payment portal that is instinctive and uncomplicated, they are more most likely to finish their deals without disappointment.In conclusion, a versatile repayment entrance considerably enhances purchase procedures through its durable safety functions, varied repayment choices, and intuitive user interface.

Report this page